What Waffle House and Eggs Are Telling Us About Inflation

Egg prices are an indicator of food prices which are continuing to rise while the reversal of federal policy supporting farmers is already causing pain across North Carolina.

This article was originally published on Carolina Forward’s blog.

During hurricane season, North Carolinians are often reminded of the “Waffle House Index,” which informally rates the severity of a storm based on how many Waffle Houses stay open, with or without power.

As one former head of FEMA once said, “If you get there and the Waffle House is closed? That’s really bad. That’s where you go to work.”

In addition to being the canary in the coal mine during natural disasters, the ubiquitous all-day slinger of hashbrowns may also be able to give us insight into the severity of economic disasters.

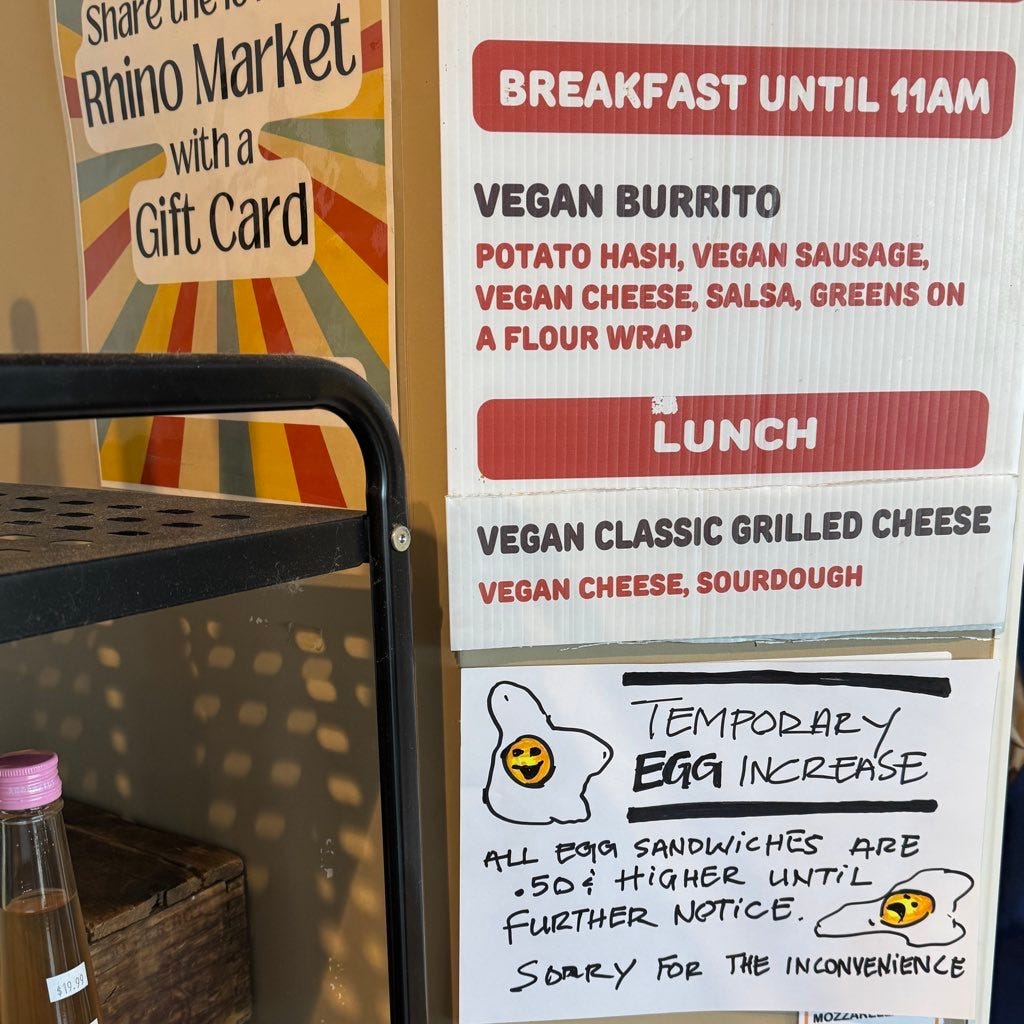

Earlier this month, Waffle House announced a 50 cent surcharge for every egg in your meal. “While we hope these price fluctuations will be short-lived we cannot predict how long this shortage will last,” the company wrote in a press release.

As the New York Times reported, “For many consumers, the price of eggs has become a tangible barometer of the economy and the rising cost of food in the United States. Shoppers who have come to rely on eggs as a traditionally inexpensive protein source have lamented about the high prices — about 37 percent higher last month than a year earlier — and empty grocery store shelves where eggs used to be plentiful.”

There are many reasons for the increase in the price of eggs, including inflation, post-pandemic price gouging, and an outbreak of bird flu that led to the destruction of over 20 million chickens in December. Relief won’t be coming soon, as the U.S. Department of Agriculture (USDA) expects prices to rise another 20% in 2025.

Pain extends to North Carolina farms

Archie Griffin, a North Carolina farmer, told WRAL the bird flu is impacting farmers across the state. “If you do make a profit, you will be 1 of 10 who does,” Griffin said.

Agriculture comprises one-sixth of the Tar Heel State’s economy, and poultry is the #1 commodity in North Carolina, contributing more than $39.7 billion to the state’s economy and creating nearly 150,000 jobs. The state’s egg layer farms can be found as far west as Alexander County, and as far east as Hyde County. North Carolina hens produce over 4 billion eggs annually, making the state a top 10 producer of “table eggs,” or the type of egg you’re most likely to see in a grocery store.

Unfortunately, a perfect storm of imperfect policy choices threatens to make things worse for both NC farmers and consumers. President Trump’s federal funding freeze has extended to blocking USDA grants, making life even harder for many farmers across the country who were already struggling to make ends meet. Food producers are being forced to choose between closing farms and increasing food prices.

“When those programs get undercut or disappear or put on hold, it really leaves us kind of hanging in the lurch,” Maine farmer Seth Kroeck told his local NBC news station, “and it’s really a breach of contract between the USDA and the farmers that have signed these contracts to do these programs.”

Additionally, Republican leaders are asking the U.S. House Committee on Agriculture to find a way to eliminate over $200 billion from the committee’s programs and the annual Farm Bill over the next 10 years, which means the Supplemental Nutrition Assistance Program (SNAP) is almost certainly on the chopping block. The program is a well-known economic stabilizer for both agriculture and the economy as a whole; increases in SNAP benefits boost income for farmers and support agricultural jobs, while decreases in SNAP funding tend to hurt the agriculture sector, leading to lower food supply and higher prices.

No help coming from Raleigh

Over the last decade or more, North Carolina’s state legislature has perversely made the grocery inflation problem even worse, at one time proposing to triple the state’s grocery tax.

In 2013, then-Speaker of the NC House Thom Tillis, along with Senate President Pro Tem Phil Berger, worked to craft so-called “tax reform” packages that pushed the tax burden from the wealthy and large corporations onto working families and small businesses. Referred to as the “Rucho Plan” after former Republican State Senator Bob Rucho of Mecklenburg county who championed the measure, the 2013 tax overhaul was a complicated system of tax cuts, increases, deductions and modifications. The net effect was a large tax cut for the wealthy while shifting a greater percentage of North Carolina’s tax burden onto lower-income earners.

Meanwhile, now-Senator Thom Tillis made it clear his tax reform priorities still put corporations ahead of his constituents, telling Punchbowl News, “you can’t reduce the tax burden on individuals unless you reduce the tax burden on businesses. And if you can only do one, you have to reduce the tax burden on businesses.”

Leaders of North Carolina’s legislature also recently set in motion the elimination of corporate taxes altogether, shifting even more of the tax burden on to consumers through taxes at the grocery store, in restaurants, and at food trucks as inflation keeps driving higher prices.

Keep an Eye on Waffle House

In their press release, Waffle House made clear that eggs are still on the menu: “As long as they are available, quality, fresh-cracked, Grade-A large eggs will remain a key ingredient in many of our customers’ favorite meals.” Only time will tell how long the 50-cent surcharge remains.

But as the Trump White House redirects federal policy towards trade protectionism, chaos in the farming industry, and the threatened deportation of up to half of American farmworkers (many of whom are undocumented), there’s little hope of relief for consumers reeling from high food prices. If anything, they may be headed even further upward, making a Waffle House breakfast pinch a little harder.

Rebekah Whilden is the interim executive director of Carolina Forward.